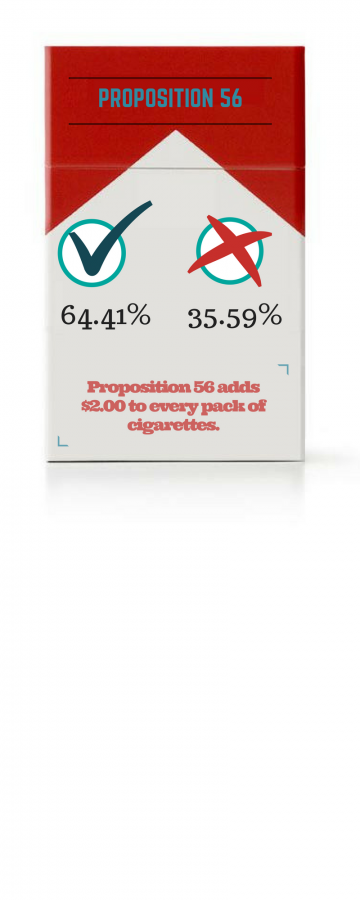

Proposition 56 takes a step towards a healthier California

Tax increase gives smokers a run for their money

The election of 2016 was one of the most memorable ones yet, but aside from the crazy presidential race, there were many important propositions up for Californians to vote on. Although some may seem uninteresting, Proposition 56 has Californian smokers worried about having to pay more for their poison.

This year has been a huge year for tobacco. The legal age for smoking was even officially raised to 21 in June. Smokers were rightfully worried, because on Nov. 8 California voters voted yes on Proposition 56. Proposition 56 raises the cigarette tax by $2 in California. Before this proposition was passed, the tax was only 87 cents. Although smokers were worried about the ballot measure’s passage, the proposition will only help them quit and get healthy.

There is no doubt about how dangerous tobacco is to a person’s health and well being. According to Action on Smoking and Health, 20 percent of all deaths in the U.S. are from tobacco-related diseases. In California alone, about 3,839,000 (ages 18+) are currently cigarette smokers. That’s 3,839,000 people in California who are putting their lives at risk every time they light one up.

According to an article in Quit Day, a smoker who smokes one pack of cigarettes in a day, will spend about $2,011 in a year. Now, if you add that extra $2 for every day of the year, that’s an added $730 in tax per person. The financial burden is not manageable for everyone, but on the bright side it can maybe help people quit because they won’t be able to afford keeping up with an addiction that’s going to kill them in the long run.

Behavioral economist Justin White, in an interview with National Public Radio, said that nearly all smokers wish they could quit. They know that smoking is terrible for them, but it’s one of the hardest habits to quit, it’s a serious addiction.

Teens who smoke will also benefit from the tax increase. While some teens do work, most of them make minimum wage. With such little money from parents or a minimum wage job, they might decide to rethink before spending money on pricy cigarettes. They can’t get addicted if they can’t afford the habit. While this tax increase isn’t exciting for smokers, it might give them a reason to quit.

The funding from the additional tax revenue is going towards multiple, beneficial causes. According to Ballotpedia, the extra funds primarily go towards funding existing healthcare programs, tobacco use prevention/control programs, tobacco-related disease research and law enforcement, University of California physician training and dental disease prevention programs.

Not only is Prop. 56 going to push people to quit, it can help to prevent diseases. The funds going towards any of the prevention programs will help to continue spreading awareness about the dangers of smoking, methods of quitting and avoiding it.

Also, the funds going towards tobacco-related research and law enforcement are going to further help people who are already sick and will keep young people from smoking. Funding research can help find cures for deadly tobacco-caused diseases.. For law enforcement, the funds can keep underaged people from smoking and give consequences to the ones who are already smoking.

Proposition 56 is taking a big step towards health and safety. The extra revenue going towards probable causes is going to be extremely beneficial for California.

Hobbies/Interests: Makeup, Music and talking

Favorite Movie: The Eternal Sunshine of the Spotless Mind

Favorite Food: pizza

Plans for the future: to...