How the GOP tax plan is a boon to all Americans

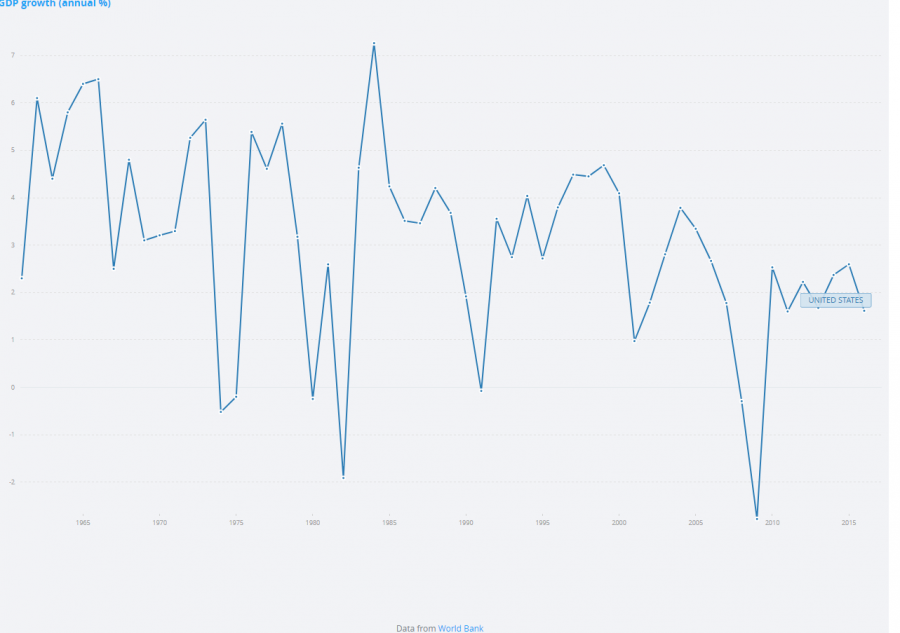

World Bank statistics showing the decline of America’s GDP over the past 10 years.

After nine years of economic stagnation due to the Great Recession and the previous presidential administration’s inability to combat it, a ray of hope in the form of economic growth can now be seen in the Republican tax plan. Over the past nine years, America’s Gross Domestic Product has been virtually stagnant, with statistics from the World Bank showing that GDP growth has usually been 1 to 1.5 percent. GDP growth is integral to America’s economy. High GDP growth will always equal more jobs and higher wages, while low GDP growth will equal the opposite.

This type of stagnant GDP growth has led to American middle class wages almost being the same for 10 years straight, with wage growth usually barely hitting the 1 percent growth mark. These statistics led to Donald Trump beating Hillary Clinton and becoming the 45th President of the United States. Trump won mainly because of his economic pitch to middle class Americans, especially Americans living in the “rust belt” states. Americans inhabiting these states have been disillusioned by how the economy has been running over the past 10 years. The jobs from these places that once employed thousands of workers are now gone, shipped to foreign countries such as Mexico and China.

Senate Majority Leader Mitch McConnell was instrumental in passing the GOP tax plan through the Senate last week

The GOP tax plan is now taking the huge step to replace the stagnation and loss of jobs in middle America especially, with prosperity. First, corporate tax will be cut from 35 percent to 20 percent. America’s corporate tax at the moment is the highest in the developed world. This is the main reason why American businesses have been shipping out American jobs and money to other countries in order to make a profit. The lowering in corporate tax will encourage American companies to start coming back to the United States, which will create jobs for Americans who need it. This fact has been backed up with historical examples such as the Kennedy tax cuts of the 1960s, with tax revenues climbing from $94 billion in 1961 to $153 billion in 1968, an increase of 62 percent.

Second, the middle class of America, which is the backbone of our country, will experience a major tax cut that will put more money in their pocketbooks. For example, a median income family of four can see a tax cut of $2,200, money that can be used for retirement or paying off a college education. The tax plan will also repeal the Obamacare individual mandate tax, which will also free up even more tax dollars for middle class Americans. Third, small businesses will gain even more incentive to grow. With the tax code now simplified, compliance costs will be reduced and will give job creators the opportunity to reinvest into their own businesses and enterprises.

This tax plan is a new era for the American economy. Jobs will come back to the jobless, the middle class will feel more empowered with more money in their pocketbooks and American businesses will start to invest again in America. This will turn America back into an economic powerhouse, unrivaled by other countries, with its citizens prospering and GDP booming.